5 Best Credit Cards for Bad Credit of December 201

Bad/Fair Credit

- Checking Account Required

- Fast and easy application process; response provided in seconds

- A genuine VISA card accepted by merchants nationwide across the USA and online

- Manageable monthly payments

- If approved, simply pay a Program Fee to open your account and access your available credit

Card Type

Unsecured

Regular APR

Annual Fee

Guaranteed Approval

No

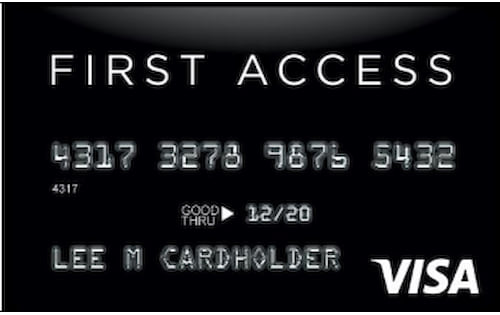

First Access Visa® Credit Card

Fair/Bad Credit

- Get the security and convenience of a full-feature, unsecured Visa® Credit Card – accepted at millions of merchant and ATM locations nationwide and online

- Reporting monthly to all three major credit reporting agencies

- Perfect credit not required for approval; we may approve you when others won’t

- Easy and secure online application

- If approved, pay a Program Fee and you can access the $300 credit limit (subject to available credit)

Card Type

Unsecured

Regular APR

See Terms*

Annual Fee

See Terms*

Guaranteed Approval

No

First PREMIER® Bank Mastercard® Credit Card

Fair / Bad Credit

- Must have checking account to qualify

- Reports to the major Consumer Reporting Agencies.

- We provide a response in 60 seconds or less.

- Bad Credit? Good Option!

- Credit limit increase eligibility after 13 months and kept your account in good standing.

Card Type

Unsecured

Regular APR

See Issuer Website

Annual Fee

See Issuer Website

Guaranteed Approval

No

You can get a credit card with bad credit, but it won’t be one of those cards you see advertised with rich rewards or exclusive perks. Instead, it will be a fairly basic card. That’s OK. You’re not going to be relying on this card forever. The idea is to use it to build or rebuild your credit, then move on to a better product.

Other options include unsecured cards for bad credit, which don’t require a deposit but tend to charge high fees that, over time, add up to more than the typical deposit on a secured card. Store credit cards can also be easier to get, although they typically have low credit limits and high interest rates, so proceed with caution. Below are our recommendations for the best credit cards for bad credit, followed by some resources for those with bad credit and some cards we suggest you avoid.Show summary